Bulls Take the Stairs, Bears Take the Elevator

Feb 27, 2022

There is an old saying on Wall Street that goes like this. The bulls take the stairs, and the bears take the elevator. Which simply means that markets tends to drop faster than they rise.

BUT WHY DOES THIS HAPPEN?

The reason be hide this phenomenon is because, generally when investors are buying a stock they tend to buy in increments over time. Slowly adding more and more capital into a position. As this occurs a stock will slowly rise up as there is buying pressure pushing a stock upwards, with minor pulls backs here and there with minimal selling pressure. However when there is a negative catalyst event that takes place, all of a sudden a stock will be met with enormous selling pressure pushing a stock to dive down. The reason why the selling pressure will be more dominate than the buying pressure during a negative catalyst event is because while investors will buy in increments over time, when it comes to selling, investors typically will sell off a majority or if not all of there position all at once. This then creates a chain of events where panic selling starts to take place and other investors will start selling off too. The selling will occur until there is a price low enough that looks promising to buy in again for investors which then introduces buying pressure that dominates over the selling pressure and a support in price is found.

Bottom line, the main different between the uptrend with bulls and and the downtrend with bears, is that during a bullish time period stocks are bought in gradually over time, while in a bearish time period stocks are sold in larger quantities as positions are being liquidated.

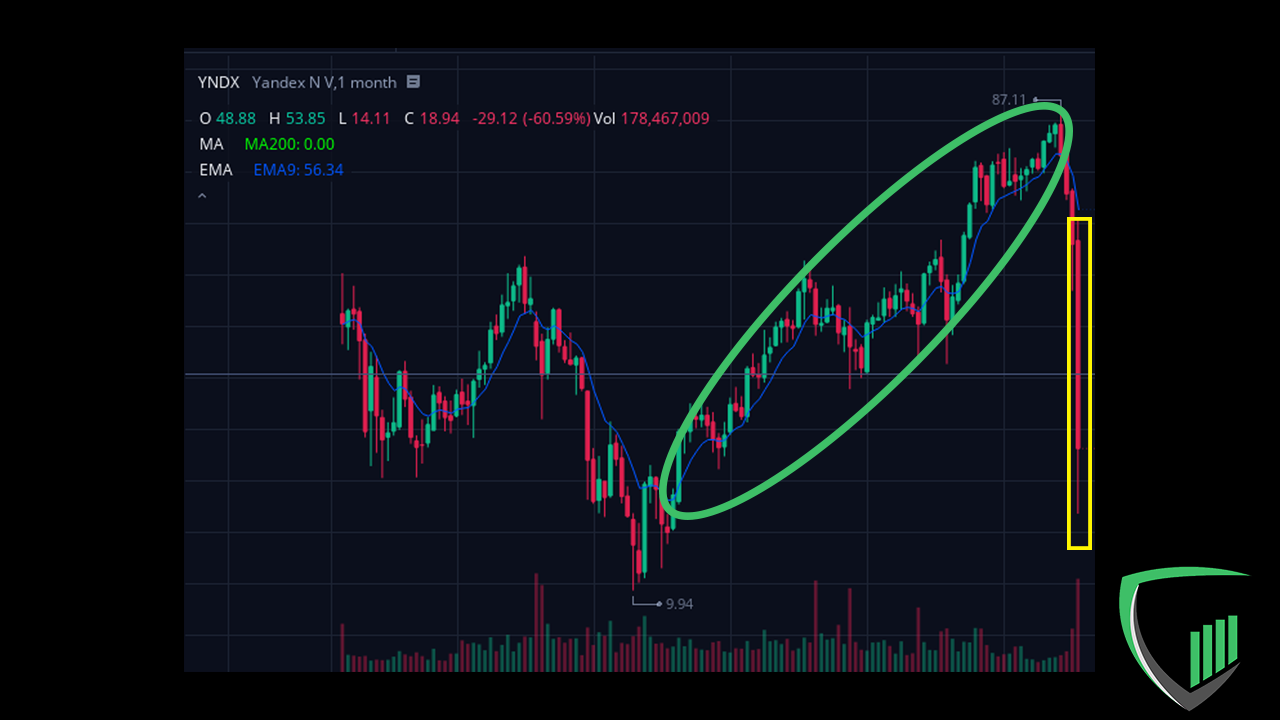

A good example to view this phenomenon take place would be on Yandex ($YNDX).

Yandex is a Russian multinational internet company. It is the biggest technology company in Russia and offers many different types of products and services. They are best known for owning the biggest search engine in Russia, but they are also involved in many other things related to technology and the internet. On this weekly Webull chart for $YNDX we can see that the stock was moving upwards overtime highlighted within the green circle, however we can see that in a very short period of time the stock took a big dive, highlighted in the yellow box. This large sell off was on 2/24/2022 when Russia invaded the Ukraine. The fall in Yandex came as the U.S. and other allied countries increased sanctions against Russia designed to negatively impact its economy and put pressure on Russian President Vladimir Putin.

As depicted on the Webull chart above, a stock will gradually move up over time when investors are placing buy orders and buying into a stock over time, but when a negative catalyst event takes place, investors will sell most or if not all of their positions causing a stock to decline rapidly in a short period of time. This why the common phase on Wall Street "The bulls take the stairs, and the bears take the elevator" has been mentioned a copious amount of times thought out history.

The Profit Post's

Weekly Newsletter

Join our FREE weekly newsletter! Each week, we will bring you the latest news and insights on market trends, and key events that every market participant should be aware of. Our newsletter is perfect for individuals looking to stay informed and ahead of the game.

We hate SPAM. We will never sell your information, for any reason.